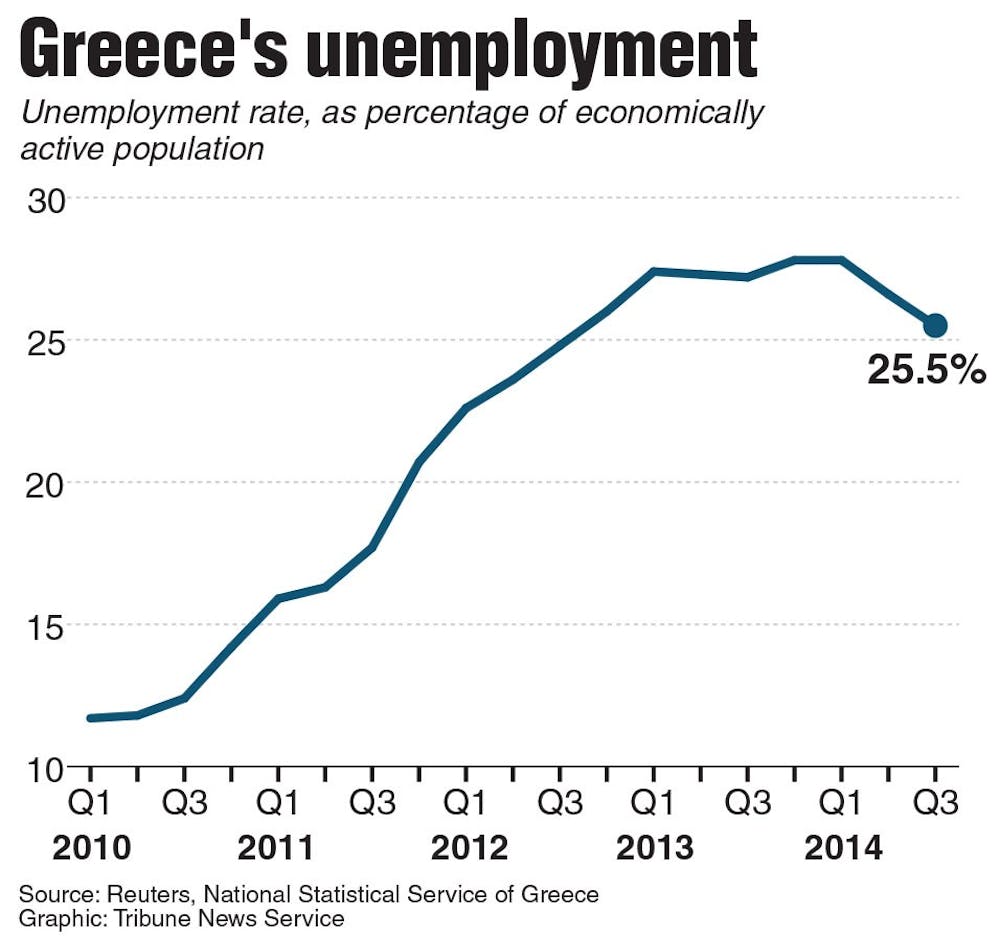

Over the weekend, Greek voters rejected a proposal from the rest of the European Union that would give Greece another loan in exchange for several cuts in Greece's national budget. With Greece already in debt to its neighbors to the tune of over 300 billion euros (or about $328 billion USD), this latest proposal was meant to be a way for Greece's banks and government to continue operating without defaulting on their previous loans while also closing some of its national budget gap (which Greece will have to do before it can pay back its debts). By rejecting the agreement, Greece is the first modern nation to miss a debt payment and risks national bankruptcy if they continue to do so.

What happens in a national bankruptcy isn't entirely clear, since no country with modern banking systems has ever dipped so far into the red. In theory, it would be much like personal bankruptcy — the bank will cancel all your checks and refuse to give you any credit while also trying to get their hands on anything you own that's worth selling. On a national scale, Greece probably doesn't have to worry about banks coming after their house (which would likely require a full scale invasion, and I don't see creditors like France or Germany as likely to engage in a full scale military campaign to get their money back), but it will have a difficult time doing any international business without any money or the capacity to get any.

The situation internally for Greek citizens is probably even worse. Greek banks have all been closed for more than a week in advance of this vote and don't seem likely to reopen until the situation has been resolved. People are limited to any cash they had in their wallets or hidden under their mattress while their bank accounts are effectively frozen. Government checks written for Euros will start bouncing if banks ever open up to cash them (since the Greek government has no funds with which to back them up), leaving high and dry the retirees and others that depend on the Greek versions of Social Security and Medicare or Medicaid as their sole source of income. Government employees will likely see their paychecks either bounce or stop completely; if these workers decide to stay home rather than provide their services for free, then Greece may descend into anarchy. This outcome can be avoided in the short term if Greece reverts to the Drachma they used as currency before joining the Eurozone, but doing so will effectively shut them off financially from the rest of Europe.

Most Americans rightly see what's happening in Greece as, unavoidable, the consequences of a nation living beyond its means. Too few, however, consider that the same thing could happen here. Greece's economic collapse is a window to our own future if we can't enact our own budget overhauls. Our federal government's debt as a share of GDP has increased from 63 percent prior to the 2008 "Great Recession" to approximately 102 percent today. Another decade of racking up debt at this rate and we'll be in the same sinking boat as Greece (whose debt to GDP ratio is 177 percent).