Environmentally-conscious USC students are joining ranks to encourage the university to freeze and remove its investments in the fossil-fuel industry, a financial move known as divestment.

Fueled by environmental and financial concerns for the future, they’ve gotten recognition from Student Government and the university’s faculty. These victories have been, in a college student’s lifespan, a long time in the making.

In 2019, Louis Rubino, a fourth-year business management student, began working on this movement by researching the university’s investments with a few other students. Initially, Rubino said, they felt they were in over their heads.

“Our research, it ended up being, ‘A lot more research has to be done, a lot more planning.' I mean, me and my little ragtag group of two other students … kind of got a little too excited, I think. Started without much planning,” Rubino said.

Rubino soon connected with the Sierra Club Student Coalition, USC’s chapter of the Sierra Club, a national grassroots environmental organization. He now runs the organization as president, with fourth-year international business student Dalton Fulcher as his vice president.

The pair hit the ground running.

“A lot of the work, especially in divestment, began early in the summer,” Fulcher said. “A lot of it has just been in building out our — the coalition's understanding of what divestment is and would look like for the university specifically.”

Soon after beginning, though, they were met with a wall. A lot of the work necessary for coalition-building, vital for a movement as this, has been very behind-the-scenes, the pair said. Fulcher and Rubino said bureaucratic work takes up most of their time. The expertise they need to move forward is siloed and disparate, Fulcher said.

Getting many students involved around this issue has been difficult, too, in large part because of COVID-19, according to Rubino.

“There's just not people on campus anymore," Rubino said. "I used to stand out on Greene Street multiple times a week, just slinging papers about whatever I was talking about … I loved it.”

This issue, according to Rubino, is one worth getting involved in.

“Our school is, you know, basically, teaching and and hiring people to research sustainability; clean energy,” Rubino said. “We're not sending people to coal plants, we're sending people to solar factories. And yet this money that we have invested is going towards institutions that are actively trying to refute the very work that the students here are doing.”

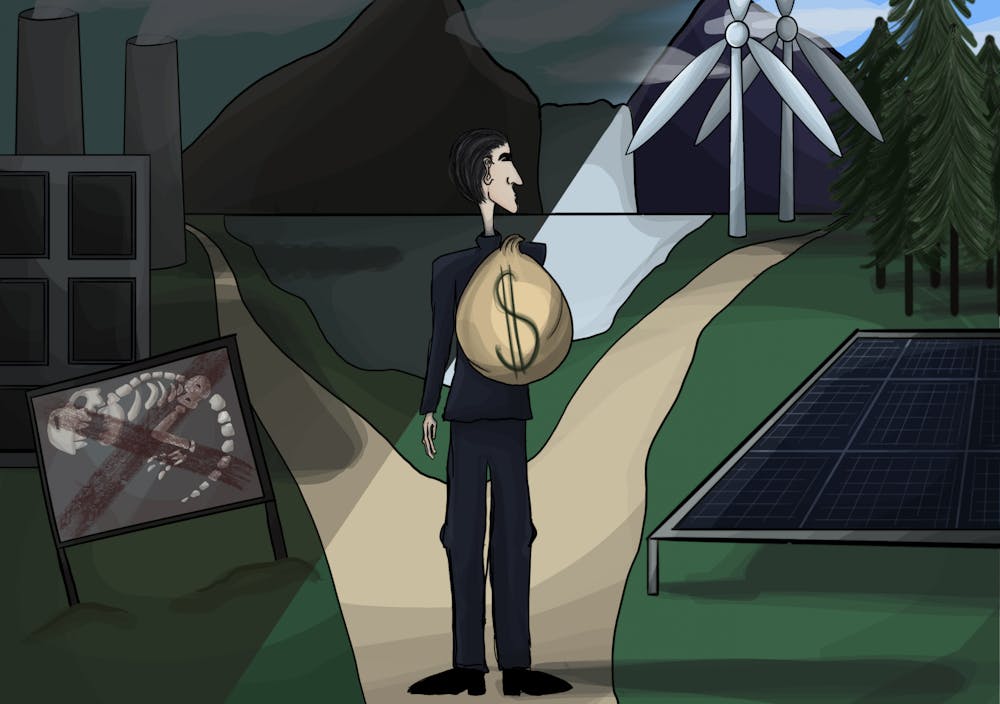

The university invests over $9.5 million directly into fossil fuel companies, with millions more invested in index funds, which are partially made up of fossil fuel companies. The divestment movement aims to change that, Fulcher said.

"The first thing is, ‘OK, stop putting more money into these things which are increasingly volatile and increasingly providing lower returns than the rest of the market.' And then we want to start taking money out of those areas of investment and putting into other ones; for example, renewable energy,” Fulcher said.

Despite difficulty getting large levels of student involvement, making calls to the right people has given the movement support among important groups. Key in this effort has been Claire Windsor, the chair of the student senate’s sustainability committee.

In the past several months, Windsor has put forward several pieces of environmental legislation, focusing on subjects such as energy conservation, carbon neutrality and divestment in the senate. All have passed, although her legislation regarding divestment saw debate.

“The long-term outlook of how fossil fuels are going to be doing is on a negative, downwards scale, so there's not really, kind of, an argument to make,” Windsor, a third-year geography and global studies student, said.

Financially, fossil fuels are on a downward trend. For years, they’ve been one of the worst-performing sectors of the S&P 500, which measures the financial performance of 500 large companies.

Faculty members are now becoming involved, as well. Conor Harrison, an associate professor in the geography department, has begun assisting Rubino, Fulcher and Windsor.

“There's been some momentum on the student side that's really developed in the last, kind of, year or two, around [divestment], which is exciting, from my perspective,” Harrison said.

Harrison has studied the relationship between energy markets and their consumers since 2011.

His role is to bring this movement and its legislation before the faculty senate. Should it pass there, as Harrison said he feels it will, the movement will attract the attention of the university’s administration, Fulcher said.

“[We’re] presenting this vision of the future to [Caslen] and to other individuals who run the university … to move things in that direction,” Fulcher said.